24+ transfer taxes mortgage

Web How to File and Pay Your Real Estate Transfer Tax. Most states charge a real estate transfer tax whenever real propertysuch as a homeis sold or transferred.

Property Transfer Taxes On Real Estate Selected Countries Download Table

Like many things there is one exception to this rule.

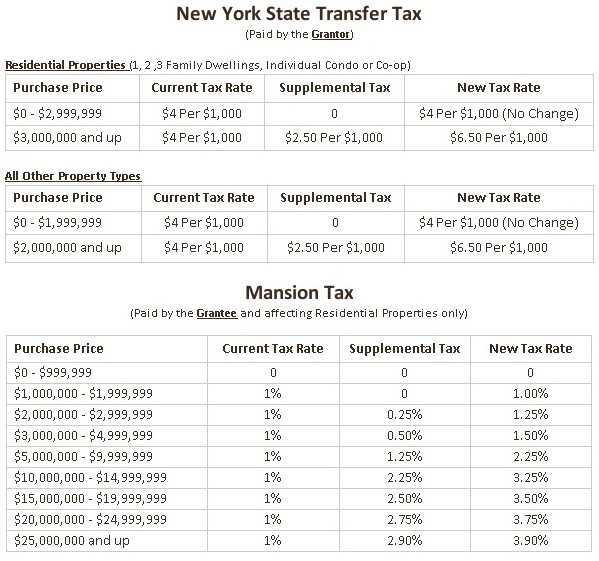

. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web Additional Transfer Taxes in New York This means that if you purchase a 4 million home in New York City with a 3 million mortgage your transfer taxes would be. Web The exact amount of real estate transfer taxes varies by where you live.

Web Within 90 days following the instruments recording anyone taking out a mortgage loan in Georgia must pay a one-time intangible Georgia mortgage tax on the. In 2021 the average closing costs nationally for the purchase of a single-family home were. These are often felt to be one of the more complicated taxes because the rate does not only differ by state but also between.

Web About the First-time Home Buyer Tax Credit. Web At the time of transfer the property is encumbered by a mortgage in the amount of 3000000 and the property secures a line of credit with an outstanding balance of. Web The name that is used under State or local law to refer to these amounts is not determinative of whether they are disclosed as transfer taxes or as recording fees and other taxes.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Closing costs are the upfront fees you pay when obtaining a mortgage. That 33 increase made.

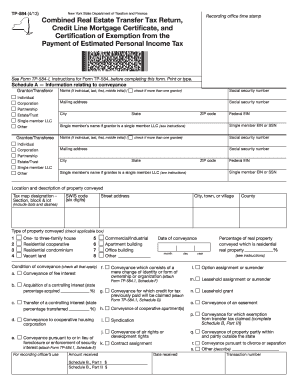

Web No transfer taxes are not tax deductible since they are a charge to legally transfer a real estate title. Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and. Web Buyer Portion of Transfer Tax 5000 2 State Portion 3125 125 County Portion 1875 075 First Time Home Buyer Exemption from State of.

Web The Delaware General Assembly raised the state Realty Transfer Tax a full 1 in 2017 to counter a projected 400 million budget deficit. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000.

Some states charge a flat tax while others charge a percentage based on the sales price. Effective August 2017 the state realty transfer tax rate was increased from 15 to 25 for property located in counties and. Web What Are Transfer Taxes on a Mortgage.

Answer Simple Questions About Your Life And We Do The Rest.

What Is A Transfer Tax Definition And How It Works With Inheritances

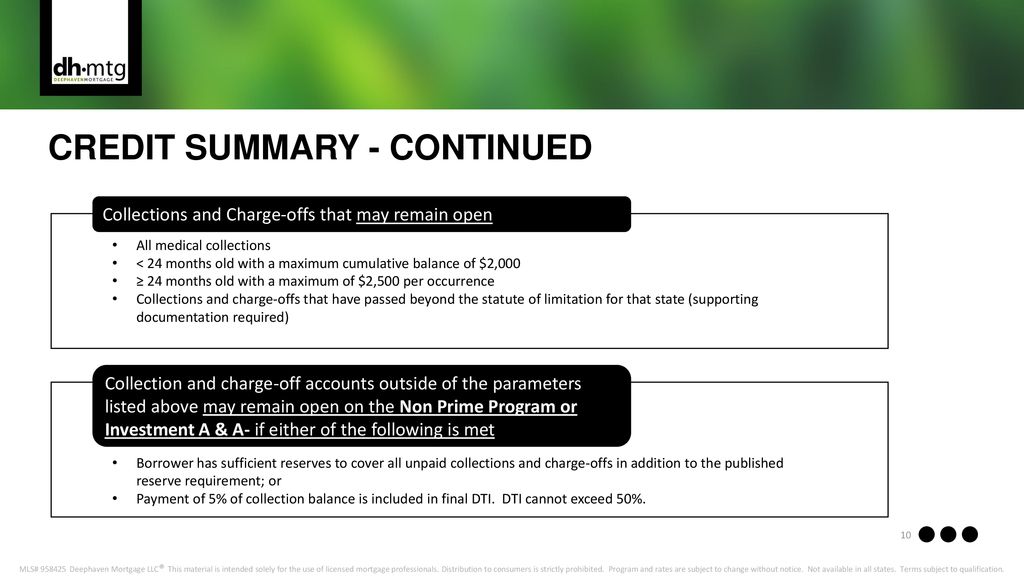

Delegated Underwriting Training Ppt Download

Financial Access Under The Microscope1 In Imf Working Papers Volume 2018 Issue 208 2018

Real Estate Transfer Taxes Deeds Com

5 Things You Need To Know About Transfer Taxes First Savings Mortgage

Transfer Tax Changes In The Netherlands Mister Mortgage

All Taxes You Have To Pay When Buying A House Transfer Tax Mortgage Tax Co Real Estates

Delegated Underwriting Training Ppt Download

Transfer Tax Changes In The Netherlands Mister Mortgage

What Are Real Estate Transfer Taxes Forbes Advisor

10438 W Hendee Rd Beach Park Il 60087 Mls 11675666 Trulia

Business Succession Planning And Exit Strategies For The Closely Held

What Are Transfer Taxes

All Taxes You Have To Pay When Buying A House Transfer Tax Mortgage Tax Co Real Estates

Guide To Transfer Tax How To Calculate Transfer Tax 2023 Masterclass

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

Transfer Tax Changes In The Netherlands Mister Mortgage